Add Leg

What is Add Leg?

The Add Leg action allows users to enter a position in the Futures, Options, or Cash segment for the selected symbol.

This action is triggered when a condition is met, executing a BUY or SELL order with configurable parameters.

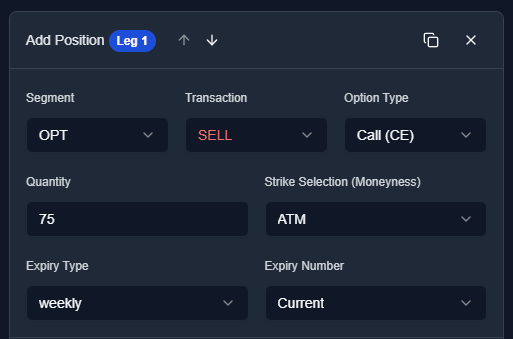

1. Trade Configuration

Segment

- Defines the market segment:

- OPT (Options)

- FUT (Futures)

- CASH (Equities) (if available for the symbol)

Transaction Type

- BUY – Places a buy order.

- SELL – Places a sell order.

Option Type (Only for Options Segment)

- CE (Call Option) – Buy/Sell a Call option.

- PE (Put Option) – Buy/Sell a Put option.

Quantity

- Defines the trade quantity in units, not lots.

- Example: If NIFTY’s lot size is 75, setting quantity to 75 is equivalent to 1 lot.

2. Strike and Expiry Selection

Strike Selection (Only for Options Segment)

-

Strike at / Moneyness:

- ATM (At The Money)

- 1-10 OTM (Out of the Money)

- 1-10 ITM (In the Money)

-

Premium Above:

- Selects the strike (CE or PE) whose premium is just above the entered value.

-

Premium Near:

- Selects the strike (CE or PE) whose premium is nearest to the entered value.

-

Premium Below:

- Selects the strike (CE or PE) whose premium is just below the entered value.

Expiry Selection (For Options & Futures)

- Expiry Type:

- Weekly

- Monthly

- Expiry Number:

- Current (Nearest expiry)

- Next (Following expiry)

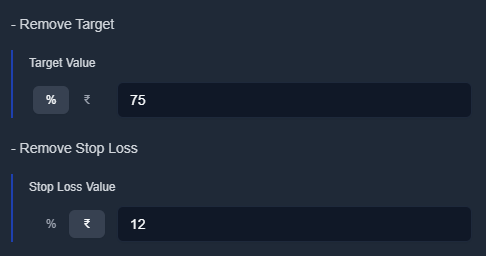

3. Target and Stop Loss

Target

-

Set as Percentage (%), Fixed Value (₹), or MTM (Mark to Market).

-

Measured from the entry price, not the executed price. The percentage and fixed value target is calculated on the entered price.

-

MTM Target:

- Based on the net profit or loss for the added position/leg.

- If net MTM profit crosses the specified value, it triggers a Square Off of the selected position/leg.

-

Execution Logic:

- For Buy Orders: Uses the high price to track the target.

- For Sell Orders: Uses the low price to track the target.

In Backtesting: Target is checked using high/low of the candle.

In Live Deployment: Target is checked on tick data.

Stop Loss

-

Set as Percentage (%), Fixed Value (₹), or MTM (Mark to Market).

-

Execution Logic:

- For Buy Orders: Uses the low price to track stop loss.

- For Sell Orders: Uses the high price to track stop loss.

-

MTM Stop Loss:

- Based on the net profit or loss for the added position/leg.

- If net MTM loss crosses the specified value, it triggers a Square Off of the selected position/leg.

Tip:

For accurate backtesting, set Stop Loss & Target above 10%.

Backtesting uses 1-minute data, and price movement (high/low) is unknown without tick data and for live it uses tickdata.

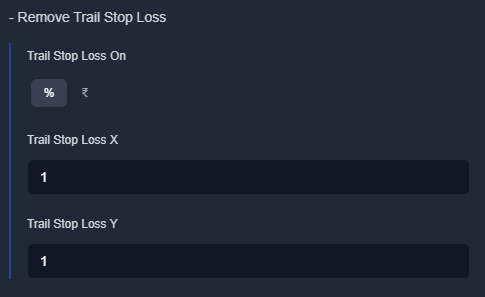

4. Trailing Stop Loss

How It Works

-

Automatically adjusts Stop Loss when the trade moves in your favor.

-

Triggered when the price moves by X% or ₹, trailing the SL by Y% or ₹.

Example:

-

Buy at ₹100, SL at ₹80.

-

If Trail X = 1%, Trail Y = 1%, SL updates as follows:

- When price reaches ₹101, SL moves to ₹81.

- When price reaches ₹102, SL moves to ₹82.

Live Deployment: Trailing SL is checked using tick data.

Backtesting: Trailing SL is checked using high/low of the candle.

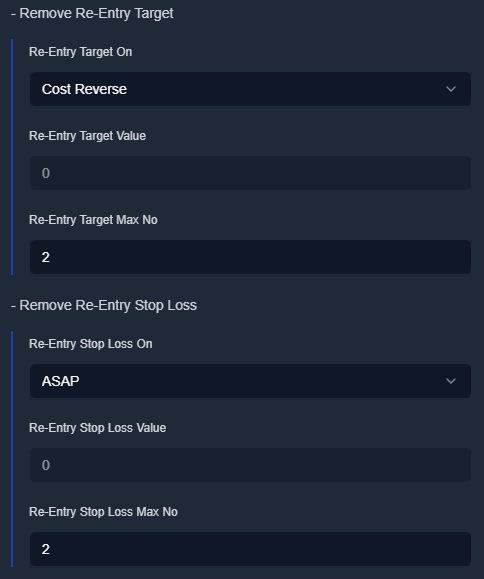

5. Re-Entry Conditions

Re-entry happens after the close of a 1-minute candle after SL/Target is hit, not immediately.

Re-Entry on Target

-

ASAP – Re-enters as soon as the previous trade hits target.

-

ASAP Reverse – Re-enters with the opposite trade type after hitting target.

-

Cost – Re-enters when the price returns to the original entry price.

-

Cost Reverse – Same as Cost, but with the opposite trade type.

-

Action - Re-enters based on a specific user-defined condition or trigger, such as a signal from another indicator or strategy event.

Re-Entry Max Value: Can be set between 1 - 20, allowing up to 20 re-entries.

Re-Entry on Stop Loss

-

ASAP – Re-enters as soon as the previous trade hits stop loss.

-

ASAP Reverse – Re-enters with the opposite trade type after SL is hit.

-

Cost – Re-enters when the price returns to the original entry price.

-

Cost Reverse – Same as Cost, but with the opposite trade type.

-

Action - Re-enters only when a custom condition is met after the previous trade hits stop loss.

Re-Entry Max Value: Can be set between 1 - 20, allowing up to 20 re-entries.

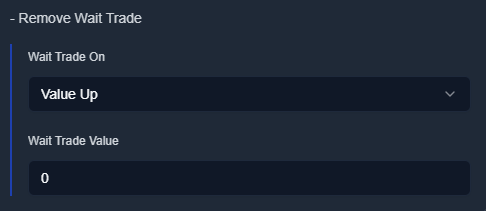

6. Wait & Trade

This feature delays trade execution until a certain price movement occurs.

Types of Wait & Trade

-

Value Up / % Up – Executes trade when price moves up by a set value/percentage.

-

Value Down / % Down – Executes trade when price moves down by a set value/percentage.

Example:

-

Current price = ₹100

-

Wait & Trade = 5% Up

-

Trade will only execute when price reaches ₹105.

Live Deployment: Wait & Trade is checked using tick data.

Backtesting: Wait & Trade is checked using high/low of the candle.