Combined Premium

What is Combined Premium?

Combined Premium is a strategy that aggregates the premiums of both Call (CE) and Put (PE) options at the same strike to analyze the total option market sentiment.

This metric helps traders understand the total cost or income from selling/buying ATM straddles, gauge volatility expectations, and build complex options-based strategies.

This method is commonly used in strategies like short straddles, long straddles, or volatility breakout systems, where the combined premium provides a benchmark for premium decay or expansion.

How to Add Combined Premium

Users can add Combined Premium by selecting from the following options:

1. Underlying

- Select the base asset

- This is the instrument (e.g., NIFTY/BANKNIFTY) for which you are analyzing the combined premium

2. Time Frame

- Defines the candle interval

(Example: 5 = 5-minute candles as shown in the image) - Sets how frequently the combined premium is recalculated and plotted

3. Candle Type

- Selected: It has Options of candlestick or Heinkenashi

4. Duration

- Specifies the historical window for the chart , It has Options from Day 1 to Day 10 .

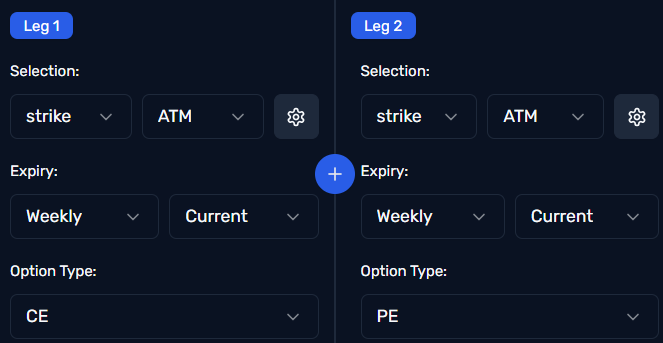

Configuration of Legs

To calculate the combined premium, we define two legs. Each leg refers to one option — CE or PE — with its own configuration.

ATM Straddle Setup (Leg 1 + Leg 2)

Leg 1: Call Option Leg (CE)

- Selection:

strike→ Choose method like:ATM: Picks At-The-Money strikePremium Above: Finds nearest strike (CE or PE) with premium above the entered valuePremium Below: Finds nearest strike (CE or PE) with premium below the entered valuePremium Near: Finds nearest strike (CE or PE) with premium closest to the entered value

- Expiry: Choose

WeeklyorMonthly - Current: Always selects the current active expiry

- Option Type:

CE(Call Option)

Leg 2: Put Option Leg (PE)

- Selection:

strike→ Choose method like:ATM: Picks At-The-Money strikePremium Above: Finds nearest strike (CE or PE) with premium above the entered valuePremium Below: Finds nearest strike (CE or PE) with premium below the entered valuePremium Near: Finds nearest strike (CE or PE) with premium closest to the entered value

- Expiry: Choose

WeeklyorMonthly - Current: Always selects the current active expiry

- Option Type:

PE(Put Option)

Together, these two legs create an ATM Straddle, and their premiums are added to calculate the Combined Premium metric.

Element Name

- Label this metric with a custom Element Name (e.g.,

combPrem) - This is useful when referencing it in your dashboard, signal builder, or strategy logic

How Combined Premium Works

Combined Premium = Call Premium (ATM CE) + Put Premium (ATM PE)

This total reflects the market’s expectation of movement.

Interpretation:

| Scenario | What It Means |

|---|---|

| High Combined Premium | Market expects volatility / big movement |

| Low Combined Premium | Market expects consolidation / low movement |

| Falling Over Time | Indicates time decay (good for short straddle) |

| Sudden Spike | Often a signal for possible breakout |

You can use the Combined Premium chart to:

- Identify breakouts (sharp upward premium movement)

- Detect time decay (slow drop in premium)

- Build mean-reversion or momentum-based strategies

Use Cases for Combined Premium

-

Straddle Trading

→ Track premium decay for selling strategies or expansion for long strategies -

Volatility Forecasting

→ Gauge how much movement the market is pricing in -

Breakout Detection

→ Sudden spikes in combined premium often signal upcoming directional moves -

Hedging & Risk Management

→ Use combined premium behavior to time entry and exits for hedged positions

Additional Notes

- Best used with ATM options for straddles

- Always ensure both legs have the same strike and same expiry

- Choose strike function as per your strategy logic (premium-based, delta-based, or OTM/ITM)

- Use Current flag to dynamically pick latest expiry

📌 This module is ideal for traders building logic-driven volatility setups or premium decay strategies across intraday and positional setups.